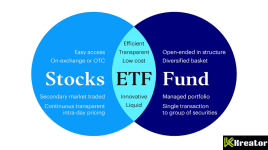

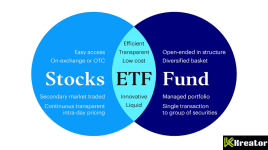

ETFs (Exchange-Traded Funds) in the context of cryptocurrency are investment vehicles that track the performance of one or more digital assets, such as Bitcoin, Ethereum, or a basket of cryptocurrencies. They allow investors to gain exposure to the crypto market without directly owning or managing the underlying assets. Here's a breakdown of how they work and their key features:

in the context of cryptocurrency are investment vehicles that track the performance of one or more digital assets, such as Bitcoin, Ethereum, or a basket of cryptocurrencies. They allow investors to gain exposure to the crypto market without directly owning or managing the underlying assets. Here's a breakdown of how they work and their key features:

---

How Crypto ETFs Work:

1. Underlying Assets:

- A crypto ETF typically holds the actual cryptocurrencies or derivatives (like futures contracts) tied to their prices.

- For example, a Bitcoin ETF might hold Bitcoin directly or use Bitcoin futures to replicate its price movements.

2. Trading on Exchanges:

- Like traditional ETFs, crypto ETFs are traded on regulated stock exchanges (e.g., NYSE, NASDAQ).

- Investors can buy and sell shares of the ETF throughout the trading day at market prices.

3. Diversification:

- Some crypto ETFs track a single cryptocurrency (e.g., Bitcoin or Ethereum), while others track a basket of multiple cryptocurrencies, providing diversification.

4. Custody and Security:

- The ETF issuer is responsible for securely storing the underlying crypto assets, often using institutional-grade custody solutions.

Types of Crypto ETFs:

1. Spot Crypto ETFs:

- These hold the actual cryptocurrencies and aim to track their spot prices.

- Example: A Bitcoin spot ETF holds Bitcoin directly.

2. Futures-Based Crypto ETFs:

- These invest in cryptocurrency futures contracts rather than holding the actual assets.

- Example: A Bitcoin futures ETF tracks the price of Bitcoin futures traded on platforms like the Chicago Mercantile Exchange (CME).

3. Thematic Crypto ETFs:

- These focus on specific themes within the crypto space, such as blockchain technology companies, mining firms, or decentralized finance (DeFi) projects.

Advantages of Crypto ETFs:

1. Accessibility:

- Investors can gain exposure to cryptocurrencies without needing to set up a crypto wallet or deal with private keys.

2. Regulated Environment:

- Crypto ETFs are subject to regulatory oversight, providing a layer of security and transparency compared to unregulated crypto exchanges.

3. Liquidity:

- ETFs are traded on traditional stock exchanges, making them highly liquid and easy to buy or sell.

4. Diversification:

- Some ETFs offer exposure to multiple cryptocurrencies, reducing the risk associated with holding a single asset.

5. Tax and Accounting Simplicity:

- Holding an ETF may simplify tax reporting compared to managing multiple crypto transactions.

---

Disadvantages of Crypto ETFs:

1. Management Fees:

- ETFs charge management fees (expense ratios), which can eat into returns over time.

2. Indirect Ownership:

- Investors do not own the actual cryptocurrencies, meaning they cannot use the assets for transactions or decentralized applications (dApps).

3. Tracking Error:

- Futures-based ETFs may not perfectly track the spot price of the underlying asset due to the nature of futures contracts.

4. Regulatory Risks:

- The approval and operation of crypto ETFs depend on regulatory decisions, which can vary by country and change over time.

Examples of Crypto ETFs:

1. ProShares Bitcoin Strategy ETF (BITO):

- The first Bitcoin futures ETF approved in the U.S., tracking Bitcoin futures contracts.

2. VanEck Bitcoin Trust (HODL):

- A spot Bitcoin ETF that holds actual Bitcoin (available in some regions outside the U.S.).

3. Grayscale Bitcoin Trust (GBTC):

- While not technically an ETF, it functions similarly, allowing investors to gain exposure to Bitcoin through a trust structure.

Regulatory Landscape:

- The approval of crypto ETFs varies by country. For example:

- The U.S. has approved Bitcoin futures ETFs but has been cautious about spot Bitcoin ETFs.

- Canada and Europe have been more open to both spot and futures-based crypto ETFs.

---

In summary, crypto ETFs provide a convenient and regulated way for traditional investors to participate in the cryptocurrency market. However, they come with trade-offs, such as fees and indirect exposure, so investors should carefully consider their goals and risk tolerance before investing.

in the context of cryptocurrency are investment vehicles that track the performance of one or more digital assets, such as Bitcoin, Ethereum, or a basket of cryptocurrencies. They allow investors to gain exposure to the crypto market without directly owning or managing the underlying assets. Here's a breakdown of how they work and their key features:

in the context of cryptocurrency are investment vehicles that track the performance of one or more digital assets, such as Bitcoin, Ethereum, or a basket of cryptocurrencies. They allow investors to gain exposure to the crypto market without directly owning or managing the underlying assets. Here's a breakdown of how they work and their key features:---

How Crypto ETFs Work:

1. Underlying Assets:

- A crypto ETF typically holds the actual cryptocurrencies or derivatives (like futures contracts) tied to their prices.

- For example, a Bitcoin ETF might hold Bitcoin directly or use Bitcoin futures to replicate its price movements.

2. Trading on Exchanges:

- Like traditional ETFs, crypto ETFs are traded on regulated stock exchanges (e.g., NYSE, NASDAQ).

- Investors can buy and sell shares of the ETF throughout the trading day at market prices.

3. Diversification:

- Some crypto ETFs track a single cryptocurrency (e.g., Bitcoin or Ethereum), while others track a basket of multiple cryptocurrencies, providing diversification.

4. Custody and Security:

- The ETF issuer is responsible for securely storing the underlying crypto assets, often using institutional-grade custody solutions.

Types of Crypto ETFs:

1. Spot Crypto ETFs:

- These hold the actual cryptocurrencies and aim to track their spot prices.

- Example: A Bitcoin spot ETF holds Bitcoin directly.

2. Futures-Based Crypto ETFs:

- These invest in cryptocurrency futures contracts rather than holding the actual assets.

- Example: A Bitcoin futures ETF tracks the price of Bitcoin futures traded on platforms like the Chicago Mercantile Exchange (CME).

3. Thematic Crypto ETFs:

- These focus on specific themes within the crypto space, such as blockchain technology companies, mining firms, or decentralized finance (DeFi) projects.

Advantages of Crypto ETFs:

1. Accessibility:

- Investors can gain exposure to cryptocurrencies without needing to set up a crypto wallet or deal with private keys.

2. Regulated Environment:

- Crypto ETFs are subject to regulatory oversight, providing a layer of security and transparency compared to unregulated crypto exchanges.

3. Liquidity:

- ETFs are traded on traditional stock exchanges, making them highly liquid and easy to buy or sell.

4. Diversification:

- Some ETFs offer exposure to multiple cryptocurrencies, reducing the risk associated with holding a single asset.

5. Tax and Accounting Simplicity:

- Holding an ETF may simplify tax reporting compared to managing multiple crypto transactions.

---

Disadvantages of Crypto ETFs:

1. Management Fees:

- ETFs charge management fees (expense ratios), which can eat into returns over time.

2. Indirect Ownership:

- Investors do not own the actual cryptocurrencies, meaning they cannot use the assets for transactions or decentralized applications (dApps).

3. Tracking Error:

- Futures-based ETFs may not perfectly track the spot price of the underlying asset due to the nature of futures contracts.

4. Regulatory Risks:

- The approval and operation of crypto ETFs depend on regulatory decisions, which can vary by country and change over time.

Examples of Crypto ETFs:

1. ProShares Bitcoin Strategy ETF (BITO):

- The first Bitcoin futures ETF approved in the U.S., tracking Bitcoin futures contracts.

2. VanEck Bitcoin Trust (HODL):

- A spot Bitcoin ETF that holds actual Bitcoin (available in some regions outside the U.S.).

3. Grayscale Bitcoin Trust (GBTC):

- While not technically an ETF, it functions similarly, allowing investors to gain exposure to Bitcoin through a trust structure.

Regulatory Landscape:

- The approval of crypto ETFs varies by country. For example:

- The U.S. has approved Bitcoin futures ETFs but has been cautious about spot Bitcoin ETFs.

- Canada and Europe have been more open to both spot and futures-based crypto ETFs.

---

In summary, crypto ETFs provide a convenient and regulated way for traditional investors to participate in the cryptocurrency market. However, they come with trade-offs, such as fees and indirect exposure, so investors should carefully consider their goals and risk tolerance before investing.